Survival Comes With A Massive Price Tag

Quick quiz: Which insurance coverage is among the fastest-growing workplace benefits?

If you said critical illness insurance, give yourself a gold star. According to LIMRA, critical illness sales were up 14% last year — double the already healthy 7% jump in overall workplace benefits sales, which rose to nearly $7.7 billion in new premium in 2019.

Meeting A Critical Need

The reason for critical illness insurance’s continued growth is painfully clear. Cardiovascular disease — heart attacks, strokes and the like — has been the leading killer of people in the U.S. for decades. And cancer will claim more than 600,000 lives this year. They’re the top two causes of adult death in this country.

Health experts don’t see a change in these trends anytime soon. The American Heart Association predicts 40% of the U.S. population will suffer from some form of cardiovascular disease by 2030 — that’s more than 100 million people. And the American Cancer Society expects more than 1.8 million new cancer cases will be diagnosed this year.

On the positive side, advances in medical treatment, technology and early detection mean many more people are surviving cancer and heart attacks. Decades ago, a heart attack killed up to half its victims within a few days. Now, more than 90% of people who suffer a heart attack survive, Harvard Medical School reports. Cancer survival rates have also increased substantially in the past several decades.

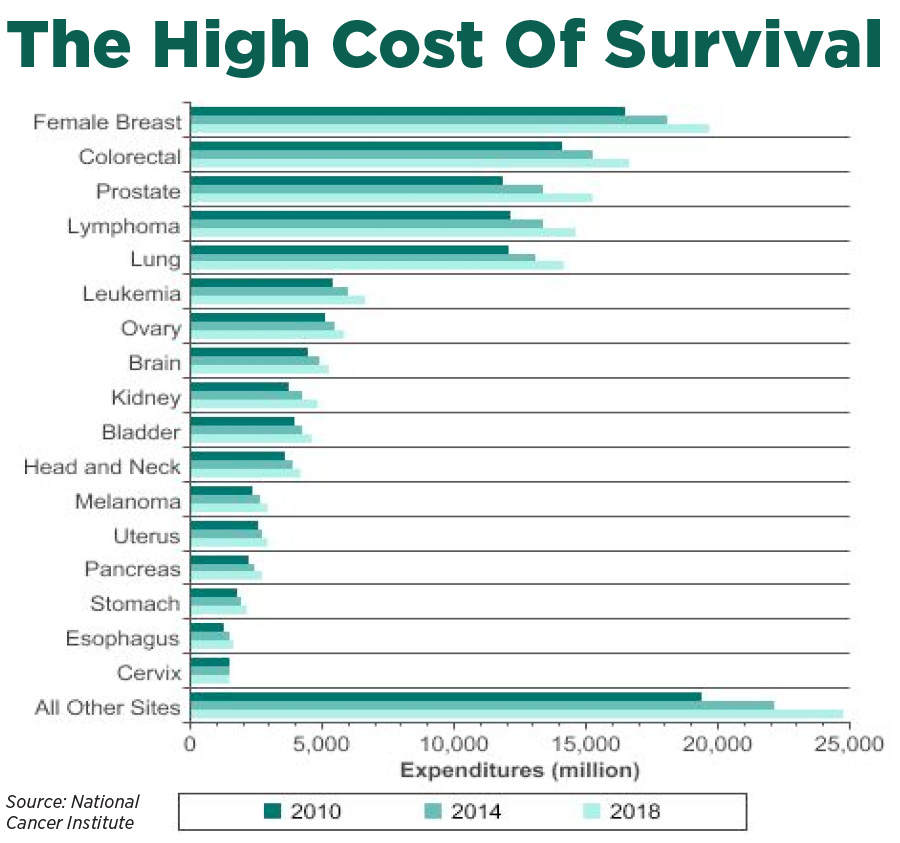

But living through a heart attack, a stroke or cancer comes with a big price tag. The National Institutes of Health estimates that the cost of cancer care in the U.S. will reach $157 billion in 2020. Meanwhile, the American Heart Association projects that the cost for cardiovascular disease treatment will more than double from $318 billion this year to $749 billion by 2035. The indirect costs of cardiovascular disease — lost time at work, paying for additional services at home, transportation, child care and other expenses — will leap more than 55% to $368 billion during that time.

No matter how robust your clients’ major medical insurance plans are, they won’t cover all these expenses. High deductibles, copayments and indirect expenses not covered by insurance can leave survivors with overwhelming bills. In fact, a recent study published in the American Journal of Medicine showed 42% of new cancer patients lose all of their life savings — an average of about $92,000 — in two years because of the cost of treatment. Nearly two-thirds of cancer patients are in debt because of their treatment, and 55% of them owe at least $10,000, researchers found after tracking 9.5 million cancer patients from 2000 to 2012.

New Critical Illness Plans Meet Evolving Needs

You can help your clients make the valuable financial protection of critical illness insurance available to their employees without investing more precious dollars in their benefits plan.

Critical illness insurance is usually offered as a voluntary benefit on a group or individual platform, so employees can select the coverage and level of protection that meets their needs — and pay for it themselves. The option of attained-age pricing also can make this coverage more affordable, especially with a younger employee population.

Critical illness insurance is usually not available — or it’s too expensive — for individuals to buy on their own. The ability to get this coverage affordably and conveniently at work is a perk that will help employees appreciate the value of their benefits package. In addition, they don’t have to worry about qualifying for coverage if it’s offered on a guaranteed-issue basis.

The benefits industry is responding by introducing new versions of critical illness insurance that add even more value. Here are some of the enhancements to look for in the critical illness product you bring to your clients:

• Expanded coverage for broader protection. One way the newer versions of critical illness plans are increasing their value is by expanding the conditions they cover. Some plans cover 50 or more different serious conditions such as heart attack, stroke, cancer, organ failure or coronary artery bypass graft surgery. Additional conditions covered for children include Down syndrome, cystic fibrosis, cerebral palsy, spina bifida and cleft lip or palate, often at no additional cost.

In addition, some plans pay benefits for multiple different critical illnesses as well as reoccurrence of the same illness. Look for those that cover a reoccurrence of invasive cancer, including breast cancer.

• Customization to meet individual needs. A one-size-fits-all benefits package is unlikely to meet the needs of a diverse employee population, and neither will a single-option critical illness plan. The newer critical illness plans provide many options so your clients and their employees can tailor coverage to their unique needs.

Your clients should expect a choice of several different plan designs with different features. For example, a plan that includes more cancer coverage provides a combined benefit to employees. If your clients already offer a cancer plan, they may prefer a critical illness design with less emphasis on cancer benefits.

Employees should be able to choose from different levels of coverage to meet their financial situations. They also may want to further personalize their coverage with riders that pay additional benefits for infectious diseases, cancer, first diagnosis, heart procedures or progressive diseases such as Alzheimer’s disease.

• Infectious disease coverage. The news tells us every day that COVID-19 is still spreading rapidly. And even though the vast majority of patients survive, treatment can be costly. FAIR Health, an independent nonprofit that collects health insurance claims data, estimates 15%–20% of people who seek treatment for COVID-19 may need a hospital stay. The cost runs more than $73,000 for those without health insurance and nearly $40,000 for those with private insurance using in-network providers.

One way the benefits industry is responding is by adding infectious disease coverage to critical illness insurance plans. The coverage may be offered as a rider that provides a lump-sum benefit that employees can use to help pay health care expenses, nonmedical costs or even day-to-day bills. The benefits typically are payable for hospital stays of a set number of days, such as seven or 14. Covered conditions can include COVID-19 as well as a wide range of other infectious diseases such as those caused by antibiotic-resistant bacteria, Legionnaires’ disease, meningitis, Lyme disease, sepsis and more.

• New wellness benefits. Your clients and their employees also may not realize they can get value from their critical illness protection even if they’re never diagnosed with an illness. The well-being assistance benefit on some plans pays a benefit for one of many different health screening tests, such as a colonoscopy or a mammogram. Some newer plans include coverage for the BRCA genetic test that identifies breast cancer risk.

Critical illness insurance can help your clients’ employees survive a serious illness both physically and financially. Educate your clients on the importance of critical illness insurance as an affordable option that can help employees better protect themselves and their families from the unexpected — and keep racking up those gold stars.

Source: InsuranceNewsNet. By Pam Jenkins

Support families fighting financial toxicity of cancer –here